There’s an old saying that goes, “You can’t really know where you are going until you know where you have been.” That’s true in life, and especially true when you’re investing in real estate.

Real estate investors use a rental income and expense worksheet to accurately track cash flow each and every month, calculate return on investment or “ROI,” identify opportunities to increase revenues, and make sure they are claiming every tax deduction the IRS allows.

In this article, we’ll take an in-depth look at the rental income and expense worksheet, including a quick and easy way to accurately track the financial performance of rental property to help maximize potential profits.

Let’s begin by going right to the source. According to IRS Topic No. 414 Rental Income and Expenses :

“Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income. In general, you can deduct expenses of renting property from your rental income.”

Rental Income

Security deposits are not treated as rental income if they are meant to be refunded to the tenant. Instead, a rental security deposit is recorded as a liability on the property balance sheet.

However, there are three instances when a security deposit does become rental income:

Rental Expenses

As long as a property is used as an investment intended to make a profit and not as the owner’s primary residence, deductible rental expenses can be more than the gross rental income, subject to certain limits .

Negative net income can occur when a vacant property is first purchased and the landlord is looking for a tenant. There’s no monthly rental income coming in, but operating expenses and the mortgage must still be paid.

Depreciation expenses can also create a loss by reducing taxable net income. The IRS allows residential rental property to be depreciated over a period of 27.5 years, excluding the land or lot because land does not wear out. If the cost of a home is $150,000 (not counting the lot) the annual full year depreciation would be $5,455 ($150,000 / 27.5 years).

For example, if the annual pre-tax income from a property is $5,000 and the depreciation expense taken is $5,455, the property would have a negative income of $455 for tax purposes even though there is positive cash flow of $5,000.

There are several reasons why keeping accurate records for a rental property makes good business sense.

First, accurately keeping records for a rental property lets you know if you are really making a profit, and helps you strategize on ways to maximize profits. Secondly, accurate records also make it easier to claim every deduction you are entitled to as a real estate investor. Last but not least, good record keeping also provides a paper trail if you are ever audited by the state or federal government.

There are two categories of rental property records:

There is a surprisingly large amount of paperwork to keep track of as a landlord, even when you are just getting started and own only one rental property:

Some real estate investors eventually grow their business to the point where they need a part-time or full-time salaried employee. Any salaries, benefits, payroll taxes withheld, and employer taxes also need to be tracked and reported on a quarterly and year-end basis.

It’s easy to quickly become overwhelmed by a seemingly countless number of documents and receipts that need to be kept track of.

Some investors create their own income and expense worksheet template using a simple Excel spreadsheet, OpenOffice, or Google Sheets. Other rental property owners prefer not to reinvent the wheel and use a free online system to keep track of rental property income and expenses.

Business and personal accounting programs used by real estate investors include FreshBooks , TurboTax , QuickBooks Online , Quicken , Xero , and Wave . These off-the-shelf programs are a good match for real estate investors who understand accounting and enjoy doing their own bookkeeping.

It can take a little time and effort to set up the programs to properly account for rental property income and expenses. Before purchasing the software or committing to a monthly subscription, try to download a free demo version to make sure the program does everything you need and want.

Set up a sample rental property, enter your business banking information, create a tenant, and book income and expenses for single and multiple properties. After that, generate monthly and year-end financial statements to make sure the program is easy to use and tracks every transaction properly.

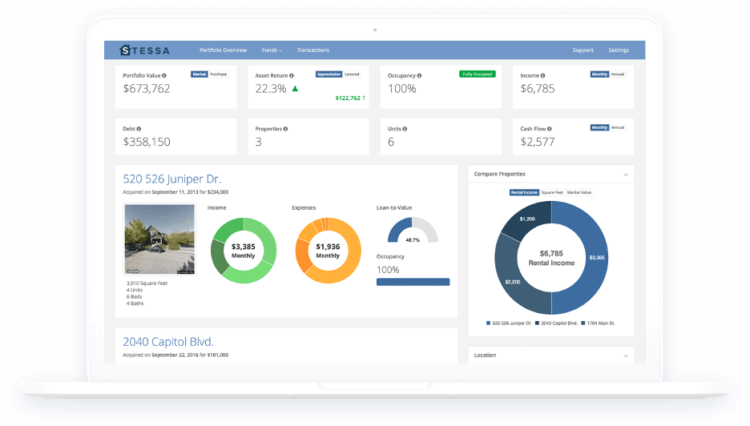

Rental property owners looking for a real estate-specific software often consider options such as Rezedent, TenantCloud, and Stessa .

Of these three, many real estate investors find that Stessa is the ideal system for automating income and expense tracking with a paper trail, and managing the financial performance of rental property. The software is perfect for smaller investors with one or two rental properties, as well as sophisticated investors with a large portfolio of rental properties.

It only takes a few minutes to create a free account, enter each property address, and link your business bank accounts. After that, personalized reporting will help you to maximize profits through smart money management and real-time reporting.

This real estate financial software has a mobile app for iOS and Android, and Stessa is 100% free .

When tax time comes around, rental property owners can visit the Stessa Tax Center to get a free tax package or fill out and file IRS forms on their own.

Rental Property Tax Return Forms

There are two main forms real estate investors use to report income and expenses to the IRS:

Occasionally rental property expenses are greater than rental income, such as when a vacant property is first purchased and the landlord is looking for a qualified tenant. Annual losses from a rental property may be limited due to passive activity loss rules and at-risk rules. Review Form 8542 Passive Activity Loss Limitations and Form 6198 At-Risk Limitations to learn if your loss is limited.

Income and Expense Records to Keep

The best system for tracking rental property income and expenses helps to monitor and improve property financial performance, prepare income statements and tax returns, and create a paper trail to identify the source of receipts and support data entered on tax returns.

If you are selected by the state or IRS for a routine audit, you may be asked to prove that the information reported on your tax return is accurate.

The auditor may require you to provide copies of receipts, canceled checks and invoices, and prove that any travel or business expenses are directly related to the rental property. Failure to provide evidence that satisfies the IRS may result in additional taxes and penalties.

Additional Information on IRS Rental Property Tax Rules

Real estate investors who want to learn more about the IRS rules and regulations for rental real estate may visit the following links:

A good rental income and expense worksheet makes analyzing the current performance of property and additional investments much easier. The gross income, net income, and cash flow reported on the worksheet are used in a variety of other rental property calculations including: